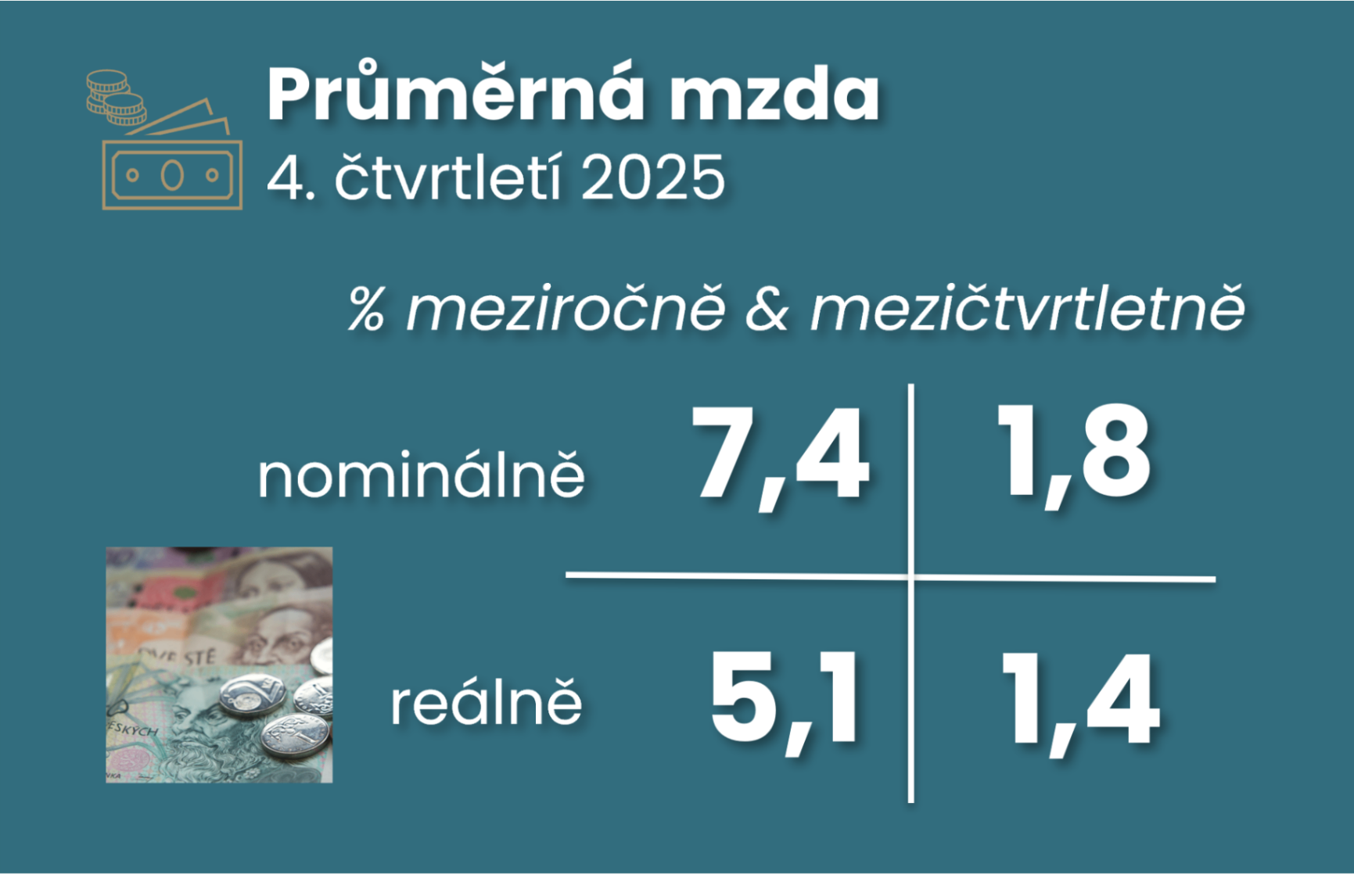

Wage growth remained strong at the end of 2025. Average wages rose by 7.4% year-on-year and added 7.2% for the year as a whole. Thanks to low inflation, this meant real wage growth of 4.7%, higher than forecast. While nominal growth should slow this year, real wages may continue to grow solidly. The average nominal wage reached CZK 49.2 thousand last year, surpassing CZK 50 thousand at the end of the year on a seasonally adjusted basis and reaching almost CZK 51 thousand in market sectors. The median wage of CZK 42 thousand was approximately 85% of the average wage.

Actualities

News, special events, current topics. Don't miss the CBA Monitor online news. The latest articles from the world of economics and its development from the Czech Banking Association clearly and in one place.

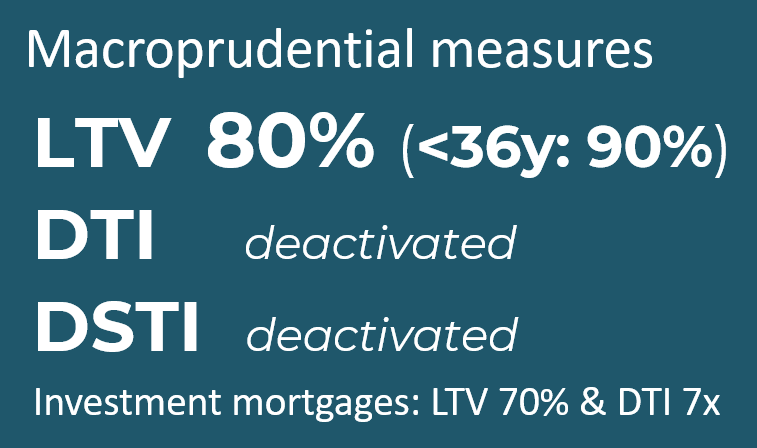

The current growth in credit activity is mainly driven by mortgage lending, on which the countercyclical buffer has a more limited impact. Although there was also a recovery in lending activity to non-financial corporations last year, these are still rather early signs of recovery and the economy needs stronger investment activity outside construction. These reasons are probably behind the central bank's decision to leave the countercyclical buffer in banks' capital unchanged at 1.25%, but with the caveat of a growing likelihood of a future increase.

Commentary of the Czech Banking Association on the development of deposits, loans and non-performing loans for December 2025 according to CNB statistics

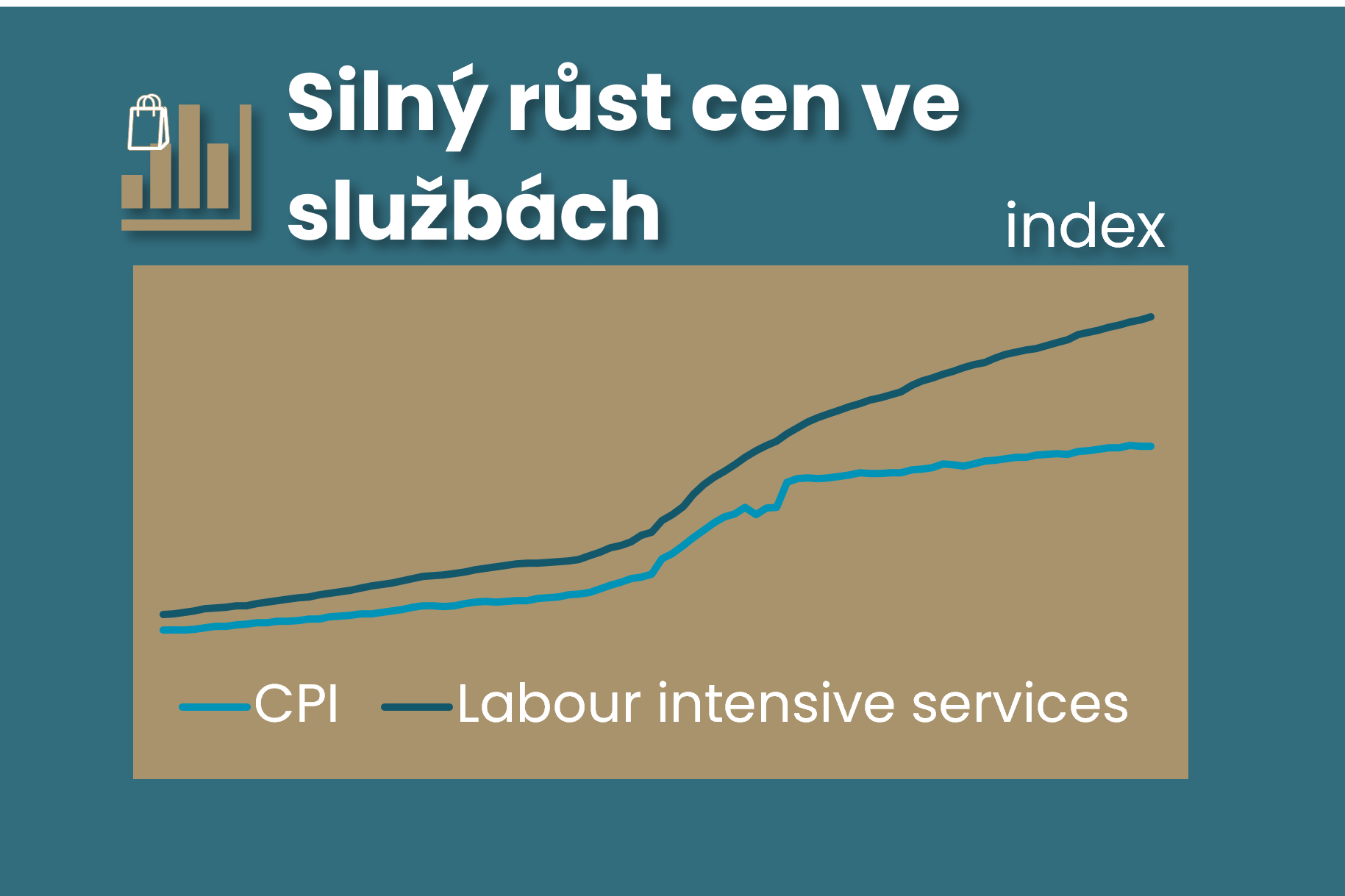

Comment by Jaromír Šindel, Chief Economist of the CBA: February consumer inflation pleasantly surprised the consensus and the central bank by slowing to 1.4% year-on-year. The inflation was mainly helped by a further decline in food prices, but also by a slightly milder rise in services prices. However, the energy shock due to the Iran war, together with still higher core inflation, is likely to pull annual consumer price growth back to an average 1.7% for the rest of the half-year. Details on core inflation, and hence services prices, will be important for both the inflation outlook and the central bank's interest rate outlook in the context of continued wage and unit labour cost growth (see charts below for market developments).

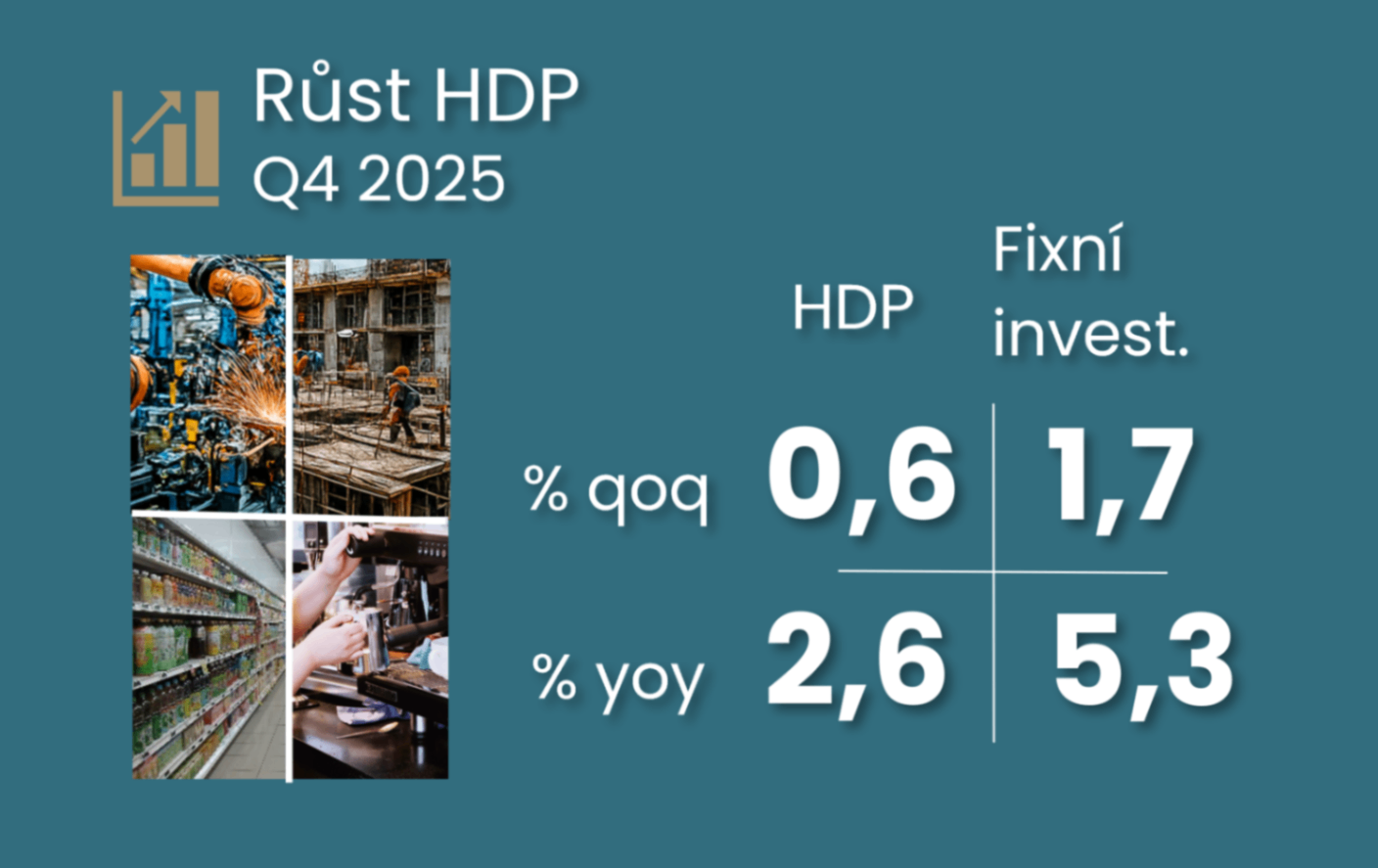

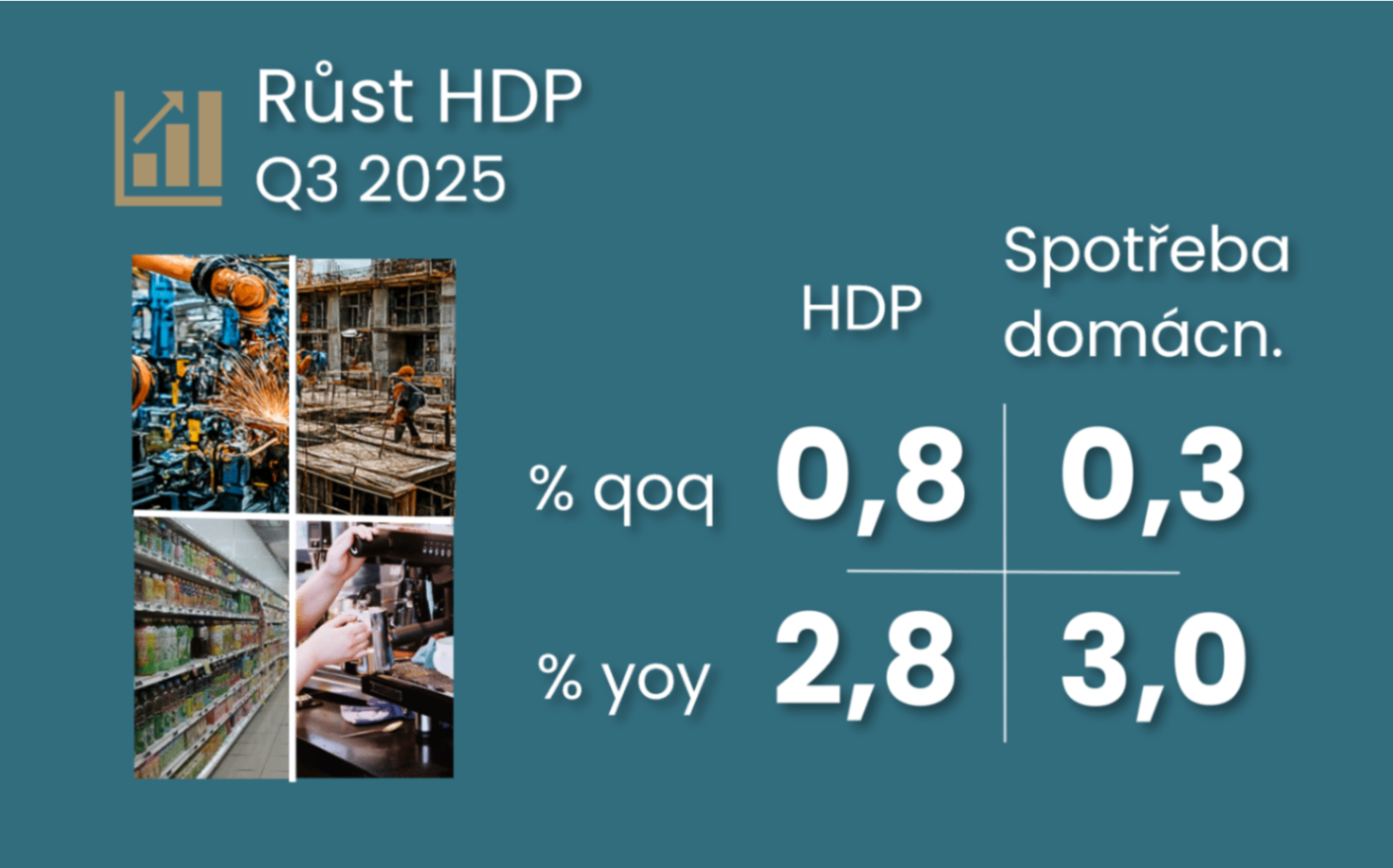

Comment by Jaromír Šindel, Chief Economist of the Czech Bank of Economics: The Czech economy closed last year with stronger growth than originally expected. The Czech economy could repeat its 2.6% annual growth this year. Household consumption was the driving force at the end of last year, supported by stronger wage growth, but also by strong growth in manufacturing. However, higher wage costs have far outpaced productivity growth, and so still elevated core inflation will remain the central bank's focus, which should result in the CNB interest rate holding steady at 3.5%.

This continues to boost activity, although not at the rapid pace seen in 2023-2024.

The CBA's forecast panel expects the domestic economy to grow by 2.6% this year and to maintain the same pace in 2027. Inflation should slow to 1.7% this year and then accelerate to 2.3% next year. However, core inflation remains elevated and represents a key upside risk to inflation, especially in services prices.

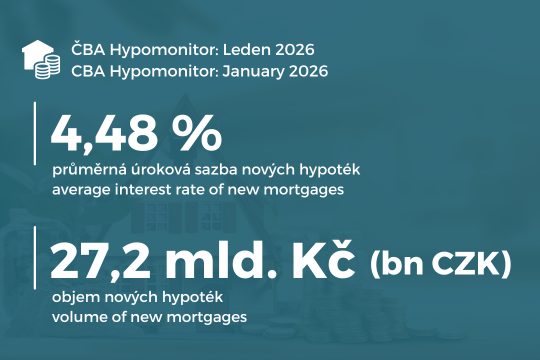

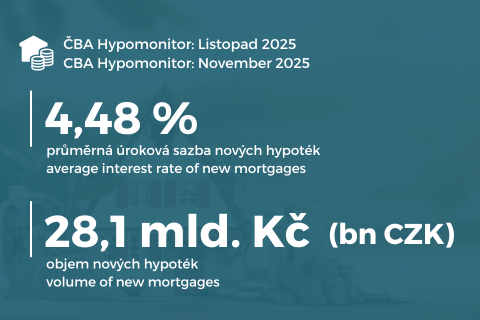

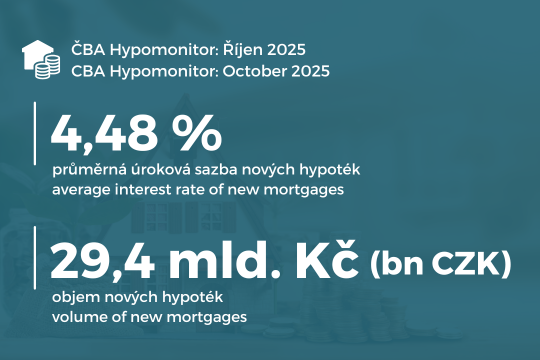

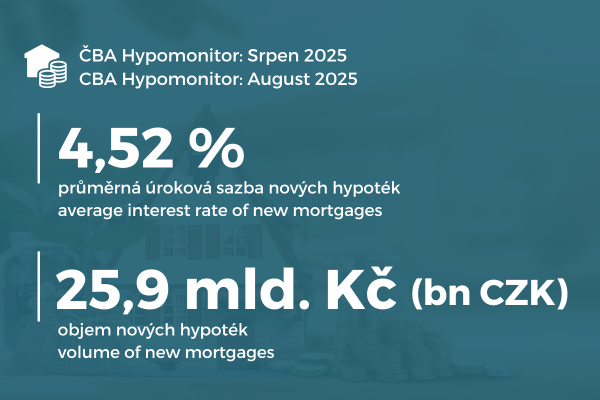

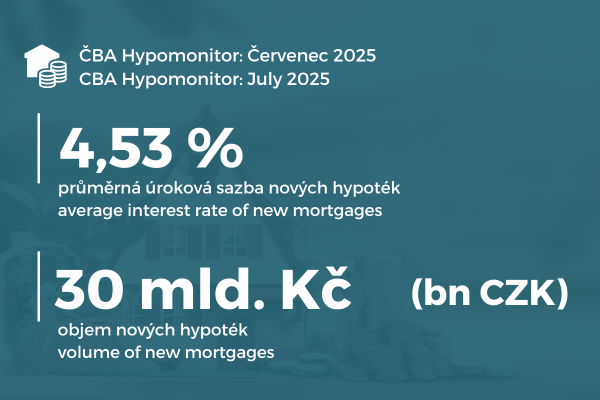

Average mortgage rate fell to 4.48%

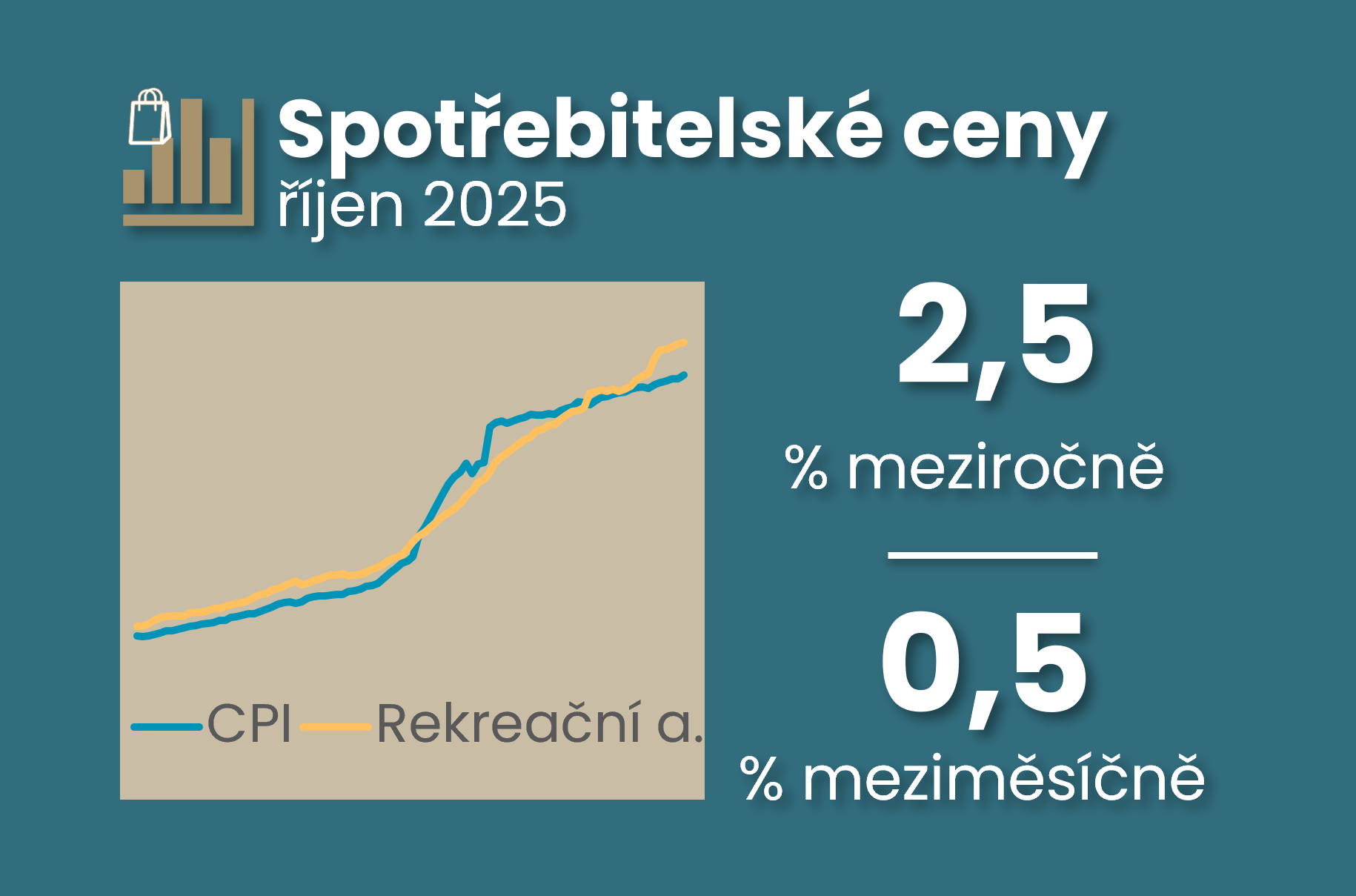

Comment by Jaromír Šindel, Chief Economist of the CBA: January's significant slowdown in consumer prices to 1.6% year-on-year mainly reflected the transfer of contributions for renewable energy from household invoices to the state budget. By contrast, core inflation eased slightly to 2.7% y/y from 2.8% at the end of last year. Food prices, which had contributed significantly to the moderation of inflation at the end of last year, rose in January, but less than would have been seasonally consistent. Consumer price growth is expected to reach around 1.7% yoy this year, following a 2.5% rise in 2025, but with core inflation still rising at around 2.5%, this will also require a disinflationary impulse, which is not yet coming from the property market segment, for example. Higher core inflation should keep the CNB interest rate steady at 3.5%, although the market is pricing in a slight cut, as are half of the CBA forecast panelists.

The Czech economy is expected to grow by 2.6% this year and should maintain the same pace next year, according to the CBA forecasting panel. Inflation should slow to 1.7% on average in 2026 and accelerate slightly again to 2.3% in 2027. However, core inflation remains elevated and represents a key upside risk to inflation, especially in services prices.

February 2026: Growth outlook steady at 2.6% with low price growth

Comment by Jaromír Šindel, Chief Economist of the CBA: December data brought a positive end to the year with continued better-than-expected industrial production, including its structure. The same is true for construction output, which returned to a better performance, but the weaker number of building permits remains a drag. Foreign trade posted an improved surplus of over 25 billion kronor in December and nearly 220 billion kronor for the full year 2025. This is equivalent to 2.6% of GDP, down from 2.8% a year ago. While retail trade did not impress at the end of the year, this was not the case for industrial wages, which returned to double-digit annualized growth at the end of the year. Overall, the December data should not prompt more dovish rhetoric from the CNB, as it does not yet signal a disinflationary contribution from the real economy towards core inflation. However, in its new, stronger outlook, the CNB is also assuming an improvement in labour productivity, which, together with tighter monetary conditions, will bring inflation back towards its target.

Comment by Jaromír Šindel, Chief Economist of the CBA: The significant slowdown in consumer prices to 1.6% year on year in January did not surprise the consensus and mainly reflects lower energy prices, but also food and fuel prices. On the contrary, I expect core inflation to remain at at least 2.8% growth from the end of last year. Although core retail sales corrected with a 0.6% month-on-month decline in December, annualized momentum, along with household plans, remains strong and does not suggest easing demand pressures. Thus, even in light of fiscal plans, interest rate stability appears to be an appropriate stance for the central bank, at least for the coming months. This is inconsistent with interest rate market targeting, but in my view this would require significantly lower core inflation pressures.

Comment by Jaromír Šindel, Chief Economist of the CBA: The January slowdown in consumer price growth to 1.6% (mainly due to fiscal intervention in regulated energy prices) was accompanied by a discussion of a possible slight reduction in the CNB interest rate in order to fine-tune the recent interest rate cycle. However, persistently higher momentum in core inflation has left its interest rate unchanged, and risks associated with service prices and fiscal policy leave all options open for the central bank to move its interest rate. This is also true in light of the central bank's new forecast outlook, which admittedly encourages a marginal short-term interest rate cut before rising to 4% as early as the end of this year. With its decision and the reiteration of both inflationary and disinflationary risks, the central bank has tempered the dovish expectations of some market participants and the outlook for a 3.5% rate still seems likely. The key is the reiteration of the thesis of the sustainability of a return to the inflation target through softer core inflation.

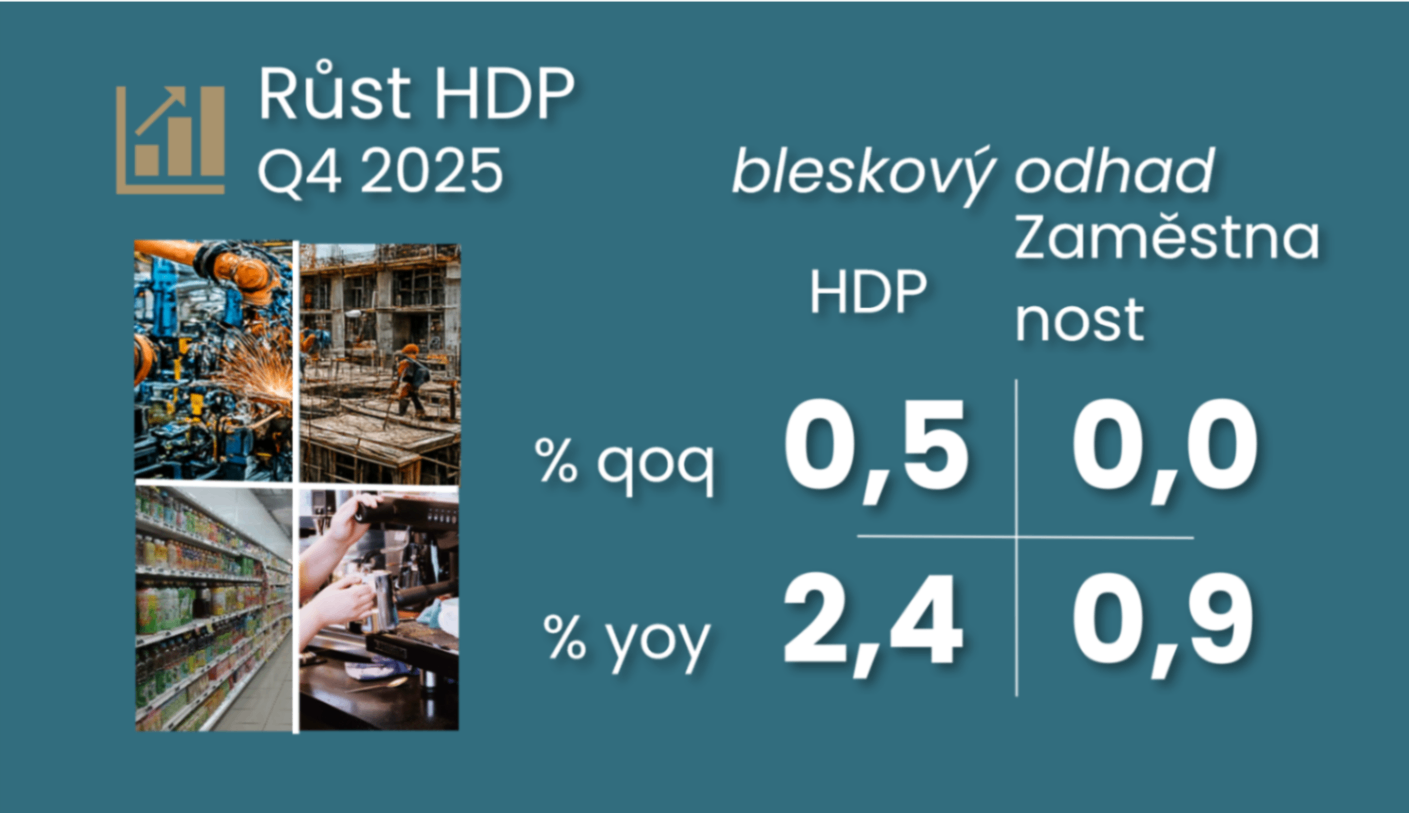

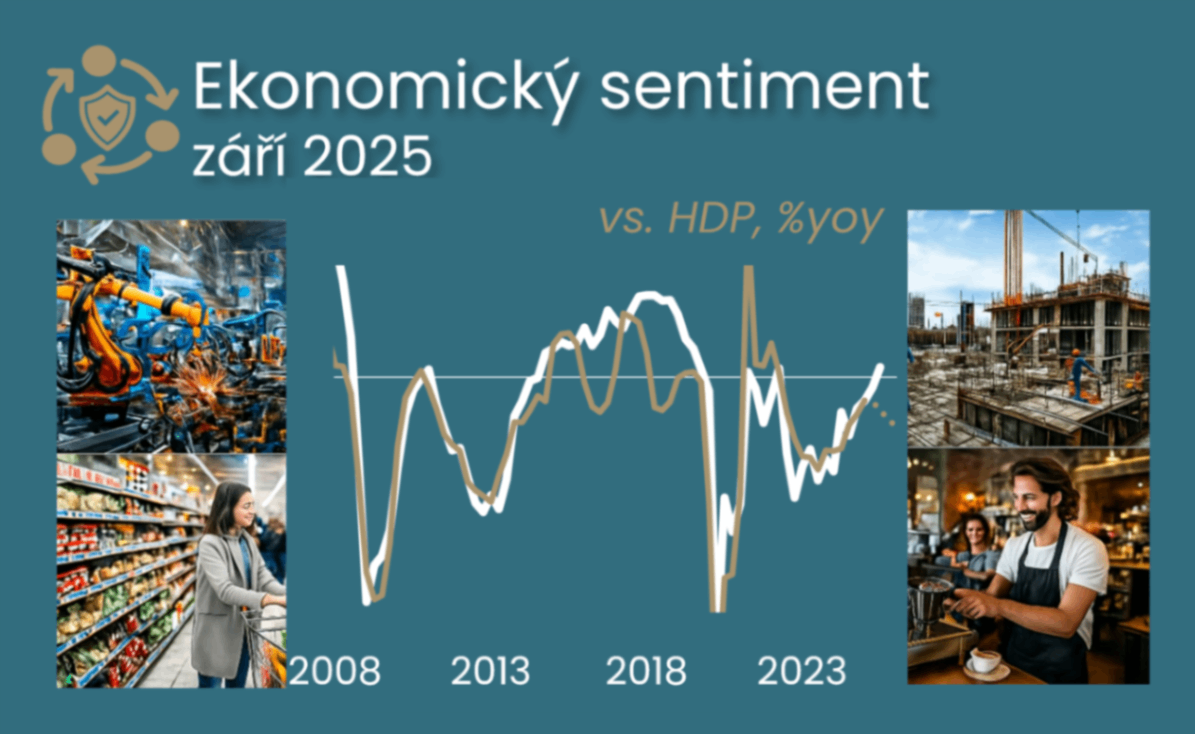

Comment by Jaromír Šindel, Chief Economist of the CBA: Economic growth slowed down at the end of last year, but still achieved solid 0.5% quarter-on-quarter GDP growth.The structure of growth has not changed significantly - consumption is dominant, which is probably not true of investment. This is in line with the latest sentiment data. A more positive sign is improving productivity. The outlook for this year is a repeat of last year's 2.5% growth, thanks to a better outlook for real wage growth and a change in fiscal policy. Conversely, weaker external demand, even given industrial sentiment, is likely to be a drag on stronger economic growth.

Comment by Jaromír Šindel, Chief Economist of the CBA: The analysis summarizes the government's regulatory steps that will further slow consumer price growth this year, probably well below 2%. What does this mean for the CBA, which seems to be starting to deflate the pigeon balloons, at least more than at the end of last year? Given its earlier communications, where inflation is headed in 2027 should be key, which will also indicate the direction of core inflation in the months ahead. And it is not just the case of still strongly rising services prices that are the focus of this analysis, the first part of the triptych ahead of the CNB's February board meeting.

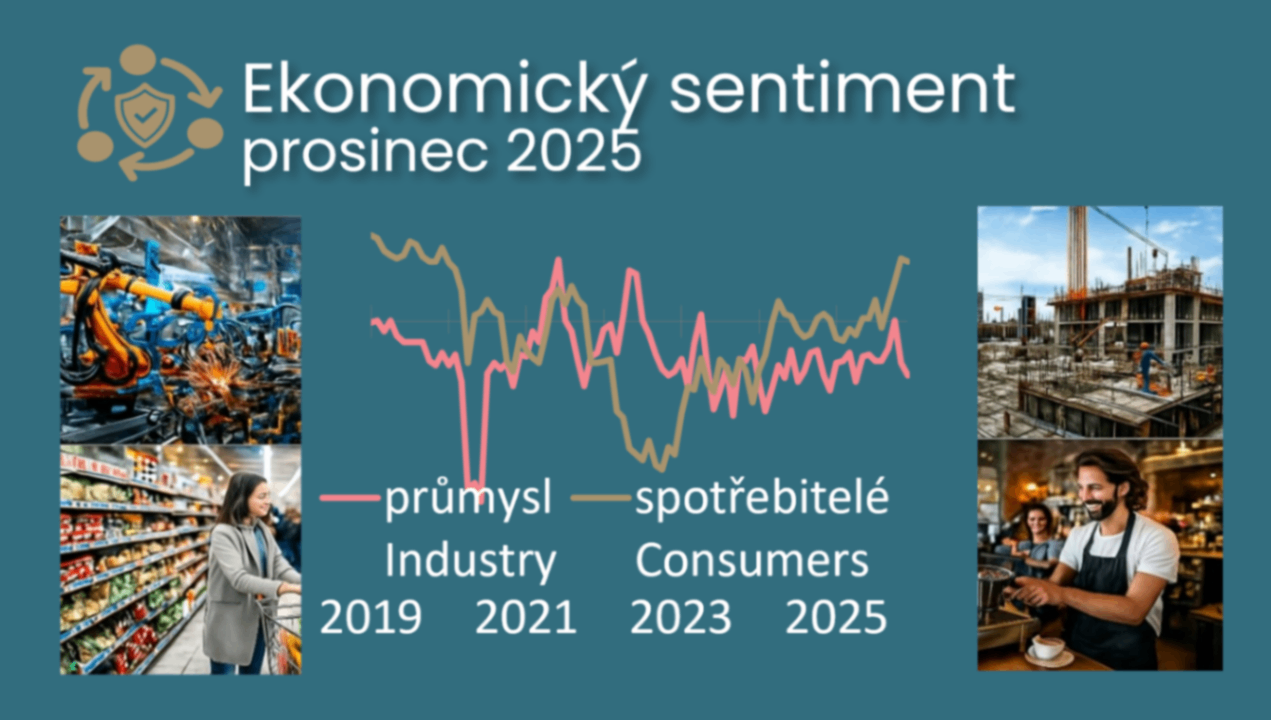

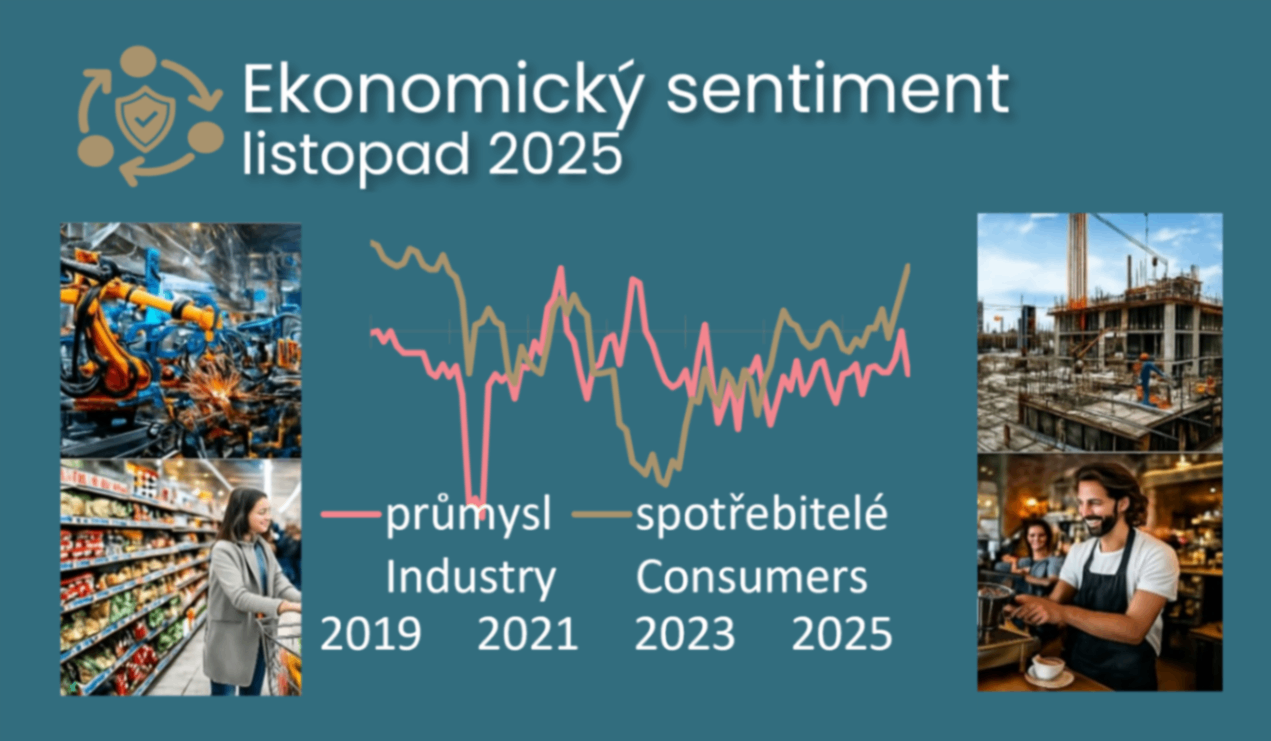

Comment by Jaromír Šindel, Chief Economist of the CBA: January show stable economic sentiment, but industry continues to be plagued by weak demand with negative consequences for investment. On the other hand, consumer purchasing plans remain full of optimism, also thanks to both lower price expectations, which are dampened by industry but not services, and better expectations on the labour market, where the service sector, which is lacking more workers, is making a positive contribution. Thus, it looks like continued solid economic growth this year with noticeably lower headline inflation. This combination is likely to shift the discussion at the CNB from rate stability or growth to rate stability or a possible decline, which is, however, not certain given the ongoing "services inflation" and the change in fiscal policy settings.

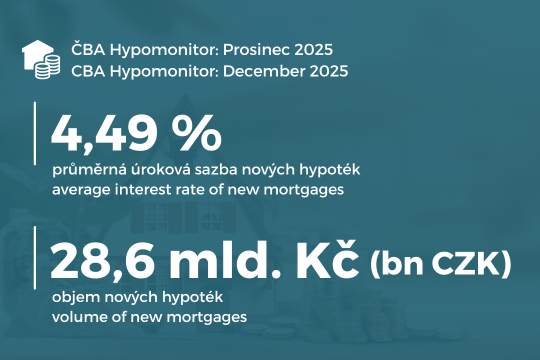

Average mortgage rate rises to 4.49%

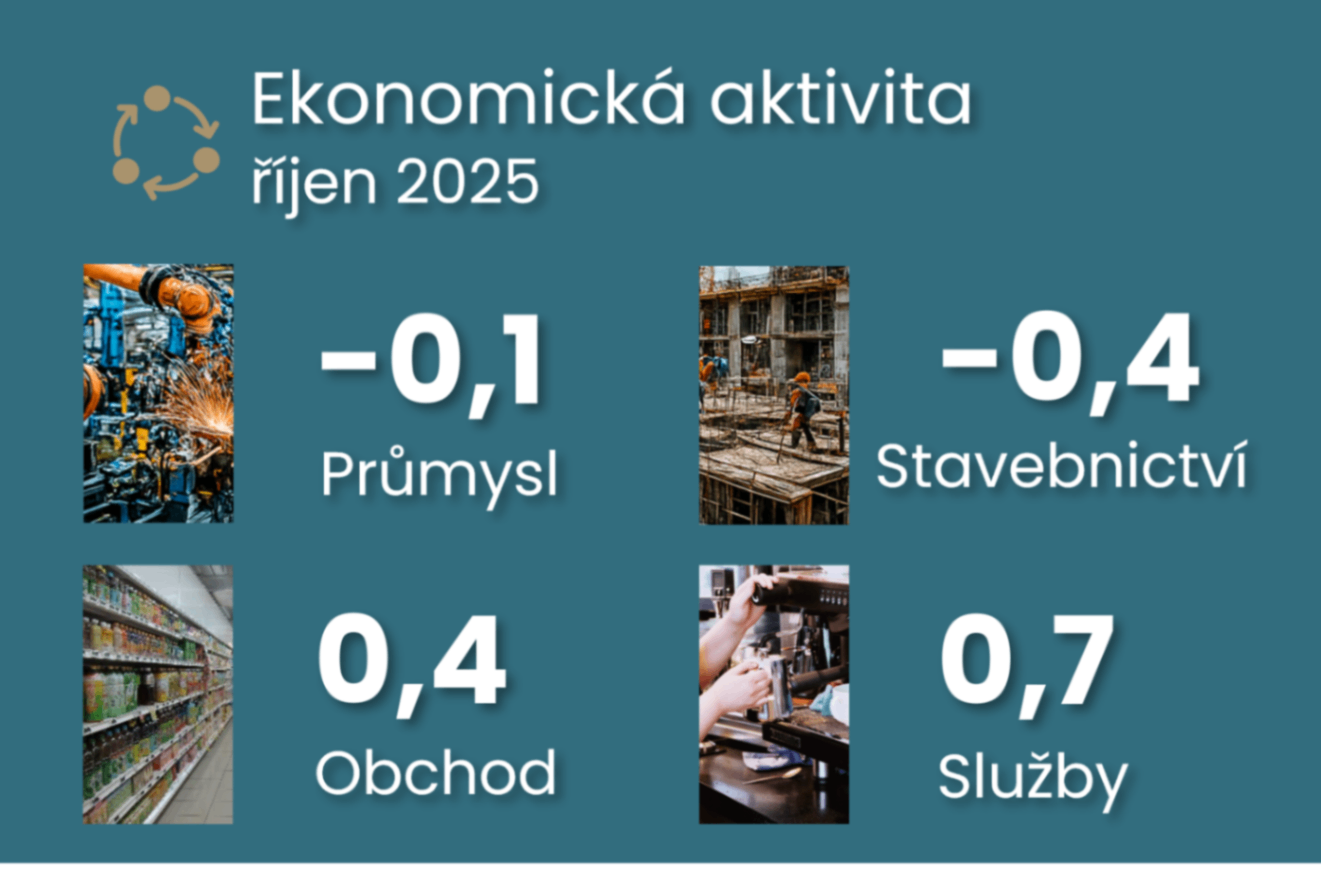

Comment by Jaromír Šindel, Chief Economist of the CBA: The November data confirm an acceleration in industrial activity, driven by the automotive industry and the recovery of energy-intensive sectors, which pushed annual industrial growth closer to 6%, the highest this year. However, further improvement may be hampered by the December decline in industrial sentiment and export expectations. Construction remains weak, and its high 7% y/y growth reflects the past rather than the current reality of limited public investment and weak building permits issued. The labour market has not yet cooled significantly despite a higher 3.3% selection unemployment rate, confirming continued solid wage growth of around 6% in industry. Quarter-on-quarter GDP growth will thus be underpinned by industrial production in Q4, probably also retail, but construction and the foreign trade surplus will rather take a bite out of it.

December inflation in the Czech Republic remained at 2.1% year-on-year and was lower than expected by the Czech National Bank and the market. Developments in food and energy prices helped keep headline inflation low, while core inflation is likely to have rebounded to 2.8% after a slowdown in November. However, both figures still missed the CNB's outlook, and this is likely to be repeated this year. This should dampen the upside risk to the central bank's interest rate, but it will remain impatient in waiting to see how fiscal policy affects the economy and inflation through 2027.

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

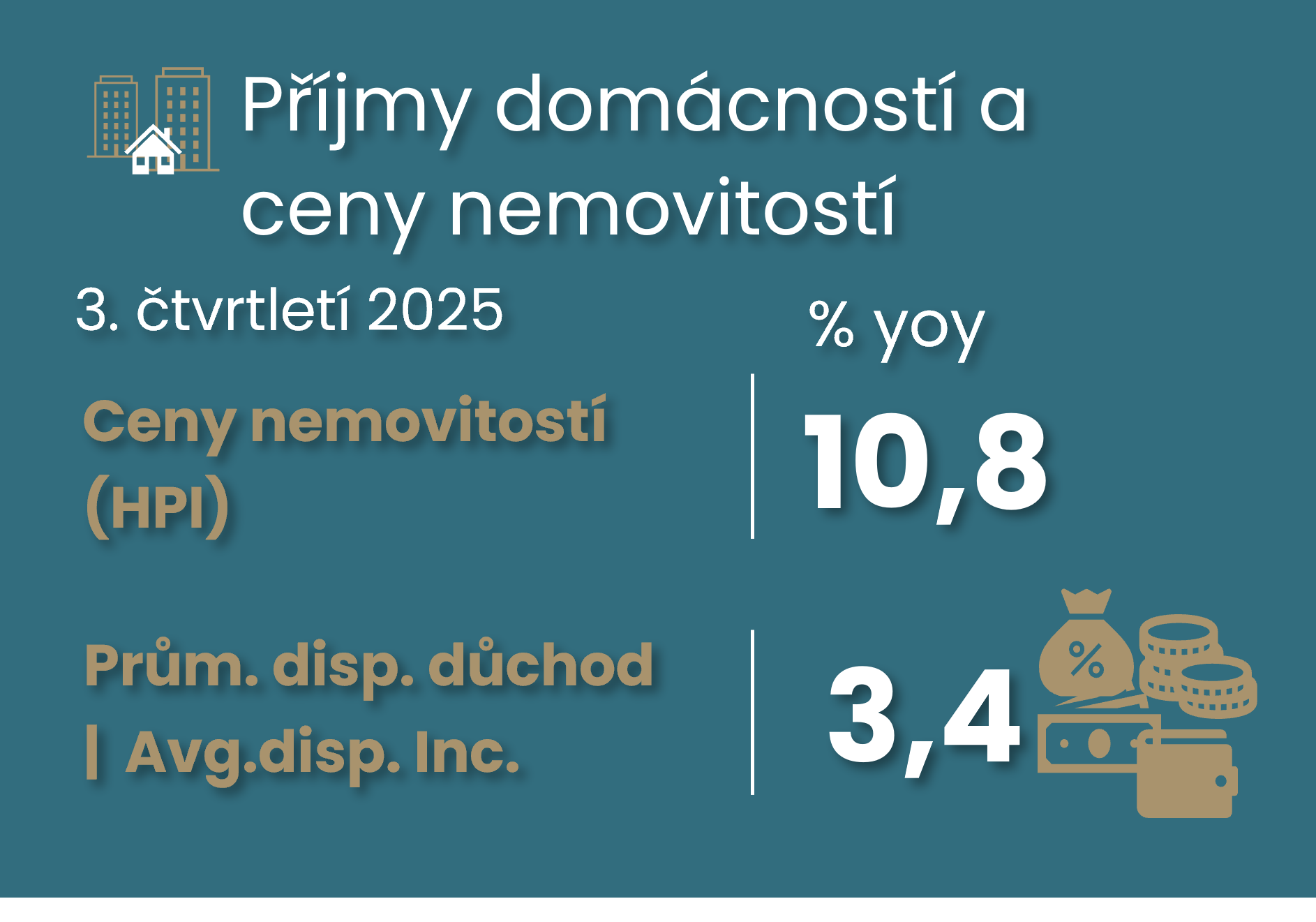

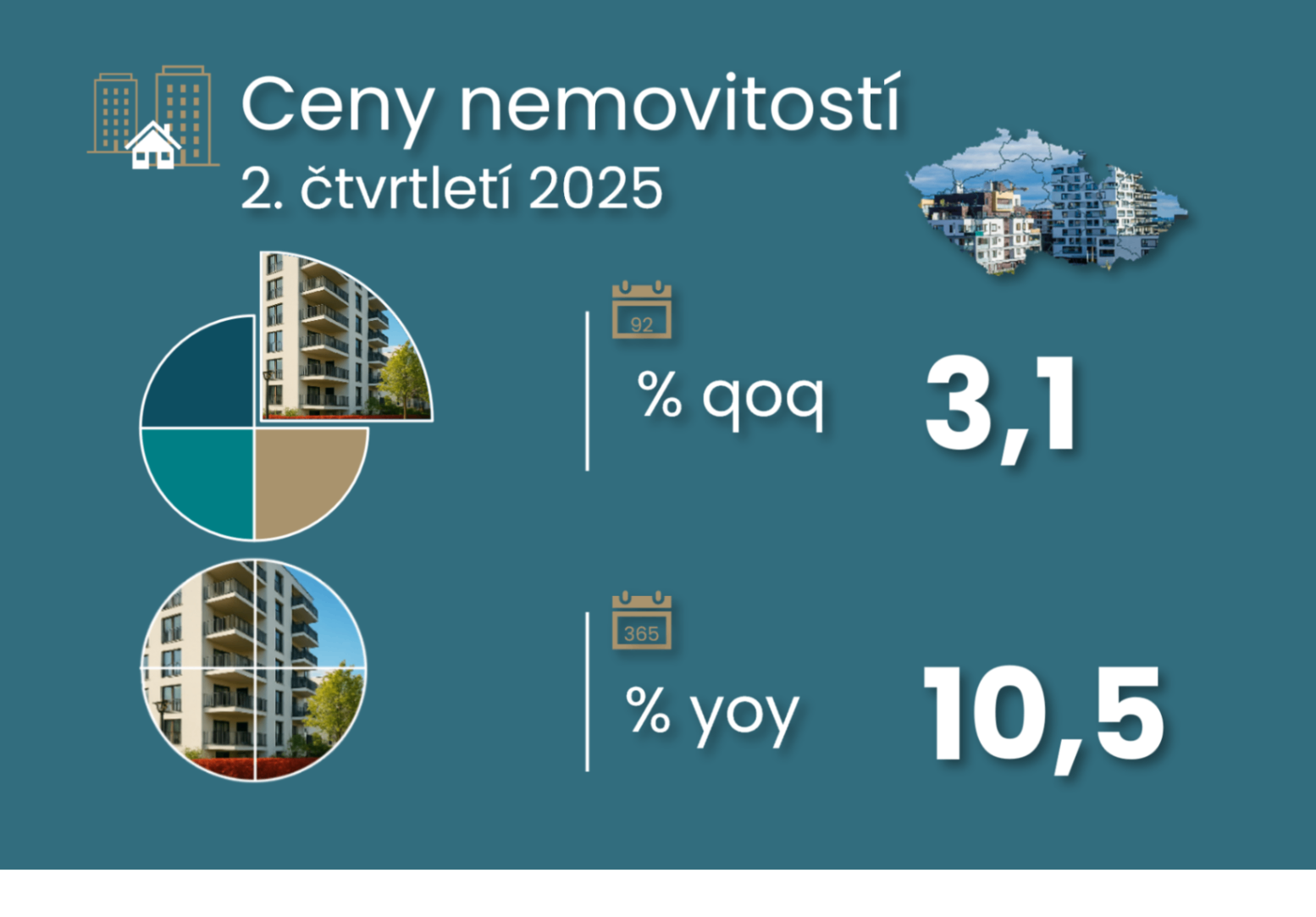

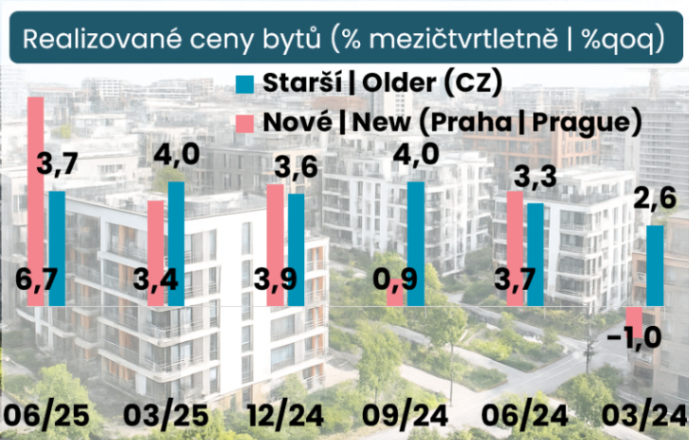

Comment by Jaromír Šindel, Chief Economist of the CBA: Even the third quarter of 2025 did not bring a significant recovery in household disposable income. Despite this, the household savings rate has been abnormally high for almost six years. In Q3, it was 18.4%. Weaker quarter-on-quarter growth in disposable income has not kept pace with house prices for six quarters in a row. On a year-over-year basis, we are comparing 3.4% growth in disposable income vs. a 10.8% increase in home purchase prices including land (HPI).

Comment by Jaromír Šindel, Chief Economist of the CBA: The deterioration in economic sentiment in December does not yet represent a turning point for the outlook for the Czech economic recovery, which anticipates a deterioration in dynamics at the end of the year 2025. Household consumption plans remain resilient, while industry and the labour market are sending rather cautious signals, which poses a risk to the expected recovery in investment activity and the early stabilisation of rising registered unemployment. The outlook for lower administered energy prices supports falling price expectations, but persistent pressures in construction and services continue to dampen disinflationary optimism, sending a neutral rather than dovish message to the central bank.

Comment by Jaromír Šindel, Chief Economist of the CBA: The central bank did not surprise by unanimously leaving interest rates unchanged, i.e. with the two-week repo rate at 3.50%, for the fifth meeting in a row after a 25bp cut in May. Although the Board did not change its view of the risks and uncertainties surrounding the CNB's November forecast, it did assess the risks to inflation as balanced, given the risks in financial markets and the removal of the renewable energy levy, following November's upside assessment.

Comment by Jaromír Šindel, Chief Economist of the CBA: According to the Czech Statistical Office, realised prices of older flats in the Czech Republic rose by 3.7% quarter-on-quarter in the third quarter, which exceeds income growth for the seventh quarter already and maintains the too brisk annual pace of property prices at around 16%. Higher property prices are also making their way into the CNB's macroprudential capital policy settings, with discussion over the (arguably unscary) possible introduction of a sectoral systemic buffer, as well as less intuitive discussions over the role of investment activity by non-financial corporates in setting the countercyclical capital buffer.

Since the beginning of the year, their volume has reached CZK 293 billion, i.e. CZK 84 billion more than a year ago.

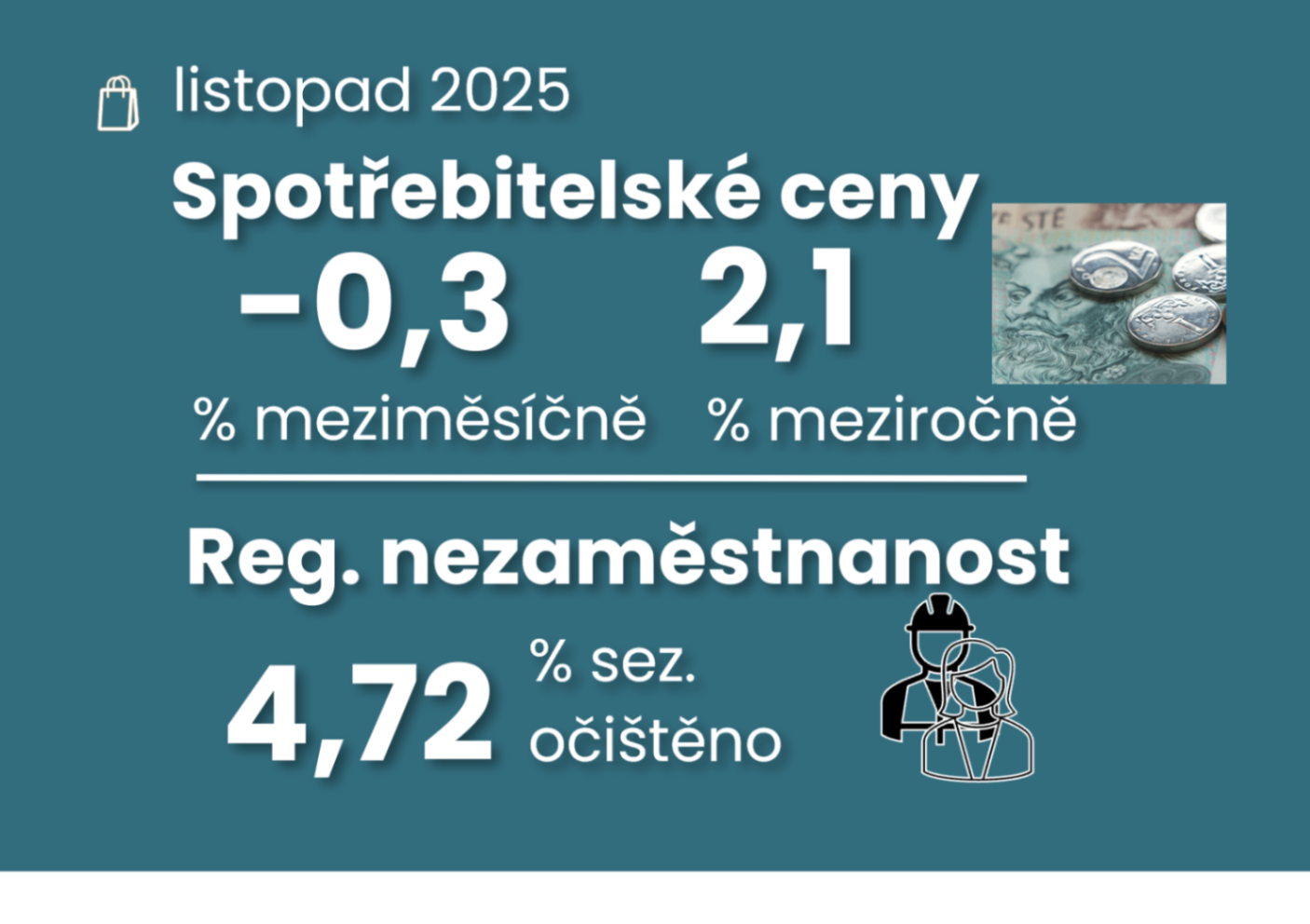

Comment by Jaromír Šindel, Chief Economist of the CBA: November consumer price growth did not slow to 2.1% year-on-year only thanks to volatile food prices, which were lower in November. The slowdown in core inflation to 2.6% was probably also due to lower prices for holidays, clothing, household furnishings, as well as lower prices in healthcare and energy. This, and November's move closer to the price inflation target for both headline and core inflation, eases hawkish pressures on the central bank. However, the continued brisk momentum in rent and food and other service prices will not allow the central bank to contemplate an interest rate cut.

Comment by Jaromír Šindel, Chief Economist of the CBA: The manufacturing part of the Czech economy remained subdued in October, which supports expectations of weaker GDP growth at the end of this year. However, a post-covetous historical foreign trade surplus is supporting the crown, which, together with a persistently solid wage pace, supported October retail sales. This part of the recent Czech growth model thus remains unchanged, but this is no longer the case for the construction sector, where persistent weakness in building permits and uncertainty over investment financing pose downside risks next year.

Comment by Jaromír Šindel, Chief Economist of the CBA: Consumer price growth slowed to 2.1% yoy in November. The main reason was a deeper decline in food prices, partly due to a slowdown in core inflation from the recent 2.8%. Thus, although inflation surprised positively, food price volatility and still strong rapid wage growth of 7.1% in Q3 will dampen the CNB's willingness to return to rate cuts. And the same reasons dampen the risks to the CBA's outlook for consumer inflation next year at around 2.2%. There remains a significant gap in the recovery in real gross wages between the market and non-market sectors.

Comment by Jaromír Šindel, Chief Economist of the CBA: The stronger quarter-on-quarter GDP growth of 0.8% in Q3 mainly reflected foreign trade, while the contribution of domestic demand was not as strong as in the previous quarter. Moreover, there has been a continuous decline in fixed investment excluding construction investment, undermining the future potential of the economy and keeping productivity growth low and fuelling inflationary growth in unit labour costs (see five key points below).

The Czech Banking Association's forecast panel expects the domestic economy to grow by 2.5% this year. A slight slowdown to 2.2% will come in 2026. Next year will also see a positive recovery in investment activity, also thanks to the return of stronger corporate lending activity in recent months.

Comment by Jaromír Šindel, Chief Economist of the CBA: The Central Bank, through stricter requirements in the form of recommendations for investment mortgages, has decided to make a modest effort to correct mortgage demand on the real estate market, which remains very tight in terms of prices, mainly due to the supply side - see the drop in building permits.

The Czech economy is expected to grow by 2.5% this year, according to the CBA's forecasting panel, with a slight slowdown of a more technical nature to 2.2% next year. The improved outlook for this year and next reflects the resilience of the Czech economy, supported by higher wage growth, government investment, de-escalation of customs disputes and, to some extent, the expected easing of fiscal policy. The recovery in investment activity will also be positive next year, also thanks to the return of stronger corporate lending activity in recent months.

November 2025: economy on track for stronger 2.5% growth despite tariff shocks

Comment by Jaromír Šindel, Chief Economist of the CBA: November's confidence in the Czech economy weakened slightly, but still suggests continued growth. However, there are significant differences across sectors, reflecting the looming change in economic policy after the elections. Households remain visibly more optimistic, thanks to rapidly rising wages and perhaps in response to the new government's plans, while industry is returning to earlier weakness. Services are again reporting rising price expectations, keeping the central bank in hawkish mode.

Since the beginning of the year, the volume of new mortgages has reached CZK 265 billion

Comment by Jaromír Šindel, Chief Economist of the CBA: October consumer inflation not only confirmed a more pronounced shock from higher food prices, but also showed higher prices of transport services and prices of means of transport as part of core inflation. In the longer term, it is worth noting that imputed rental prices have already caught up with the previous inflation shock, and the same has been true for a few months for holiday prices. Thus, the higher October inflation and unemployment data will not help the central bank or the market resolve its dilemma of the next interest rate move.

Comment by Jaromír Šindel, Chief Economist of the CBA: Retail and services sales disappointed in September despite solid wage growth, which was confirmed by September industrial wages. A gradual but steady rise in unemployment is likely to be in evidence here. Thus, the stronger GDP growth in Q3 was helped by September's industrial production, which complemented the strong construction output of the previous months. Given sentiment, things might not be different in October.

Comment by Jaromír Šindel, Chief Economist of the CBA: The CNB is waiting for a new impulse. The CNB is waiting for the new government to announce its plans, both from the data and from future analysis of the new government's upcoming plans. The CNB's own outlook, with more moderate consumer price growth at the end of the year and a stronger economy in real terms in Q3, opens up the possibility of more hawkish communication in the rest of the year. But I believe the CNB will wait to reassess its communication until the contours of the new government's policy are clearer.

Comment by Jaromír Šindel, Chief Economist of the CBA: The return of consumer price inflation to 2.5% in October will keep the CNB vigilant. Although this was due to higher food prices, the current core inflation rate remains slightly above the inflation target, which will probably be evident next spring. Although selected plans of the new coalition will help to further tame price rises, others are more likely to maintain an inflationary undercurrent in the economy.

Comment by Jaromír Šindel, Chief Economist of the CBA: The stronger koruna, lower inflation, and the return of productivity growth give the central bank some relief, allowing it to monitor how wages and the post-election fiscal plans—often pulling in opposite directions—will play out.

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

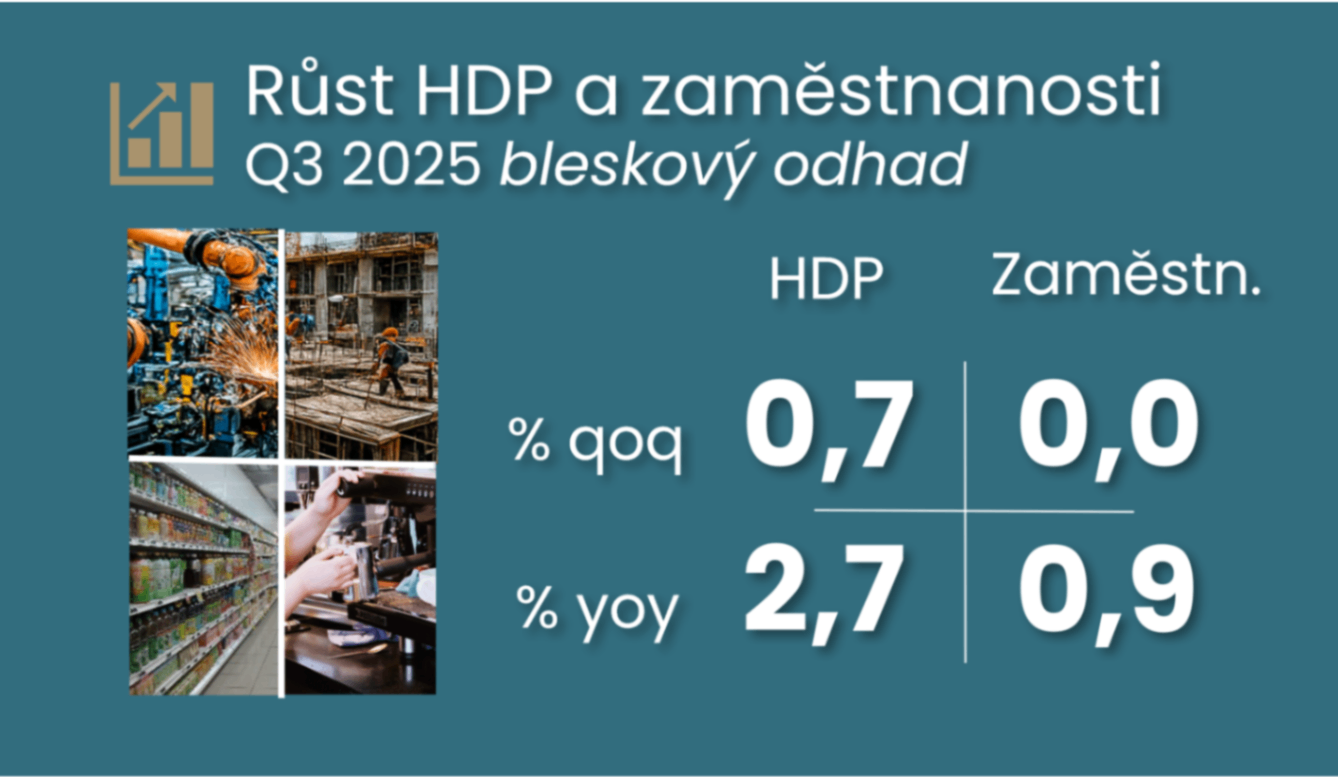

Comment by Jaromír Šindel, Chief Economist of the CBA: The return to stronger economic growth of 0.7% quarter-on-quarter in Q3 was a surprise, confirming the indications of stronger confidence in September. At the same time, stagnant employment added a welcome return to stronger productivity, which may partially dampen the hawkish impulse of stronger GDP for the CNB. The CNB will most likely leave interest rates unchanged at 3.5%, not only at the November meeting, but GDP details may set a more distinct tone to its communication later in November.

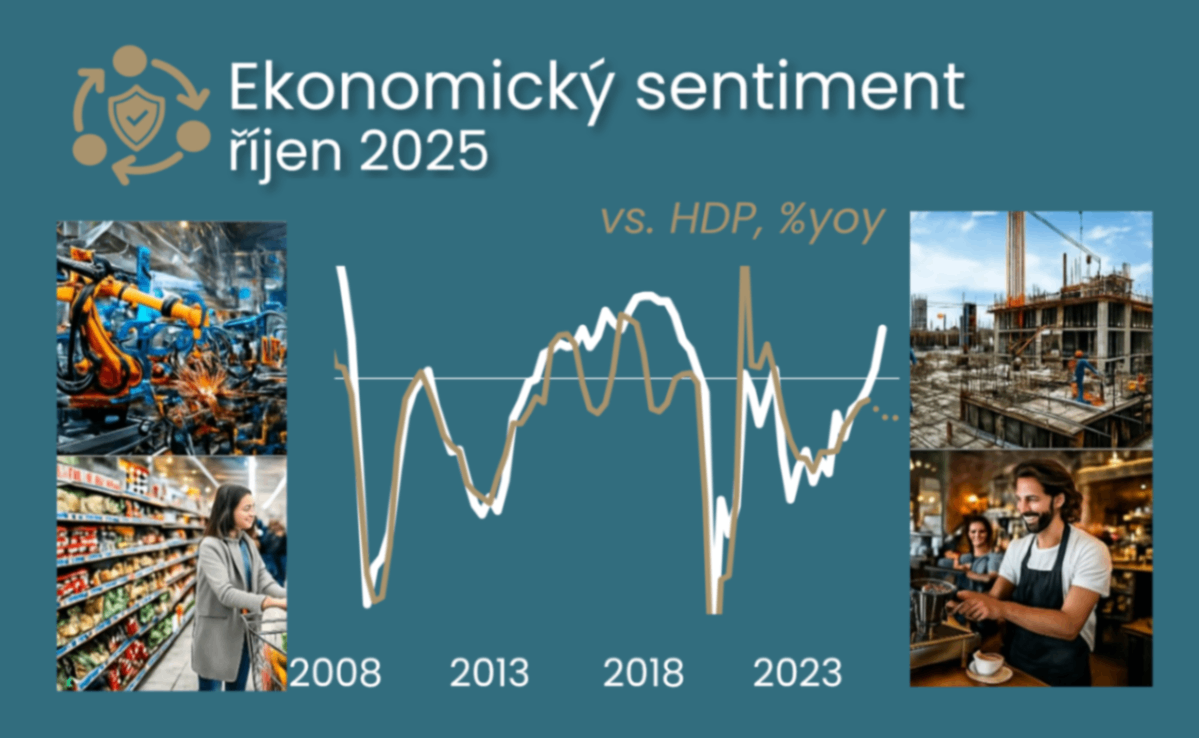

Comment by Jaromír Šindel, Chief Economist of the CBA: Stronger sentiment in October suggests a return to stronger GDP growth for the end of this year after a probably slightly worse result in Q3. Higher price expectations may delay the return of core inflation to the target.

The volume of new mortgages has reached CZK 235 billion since the beginning of the year

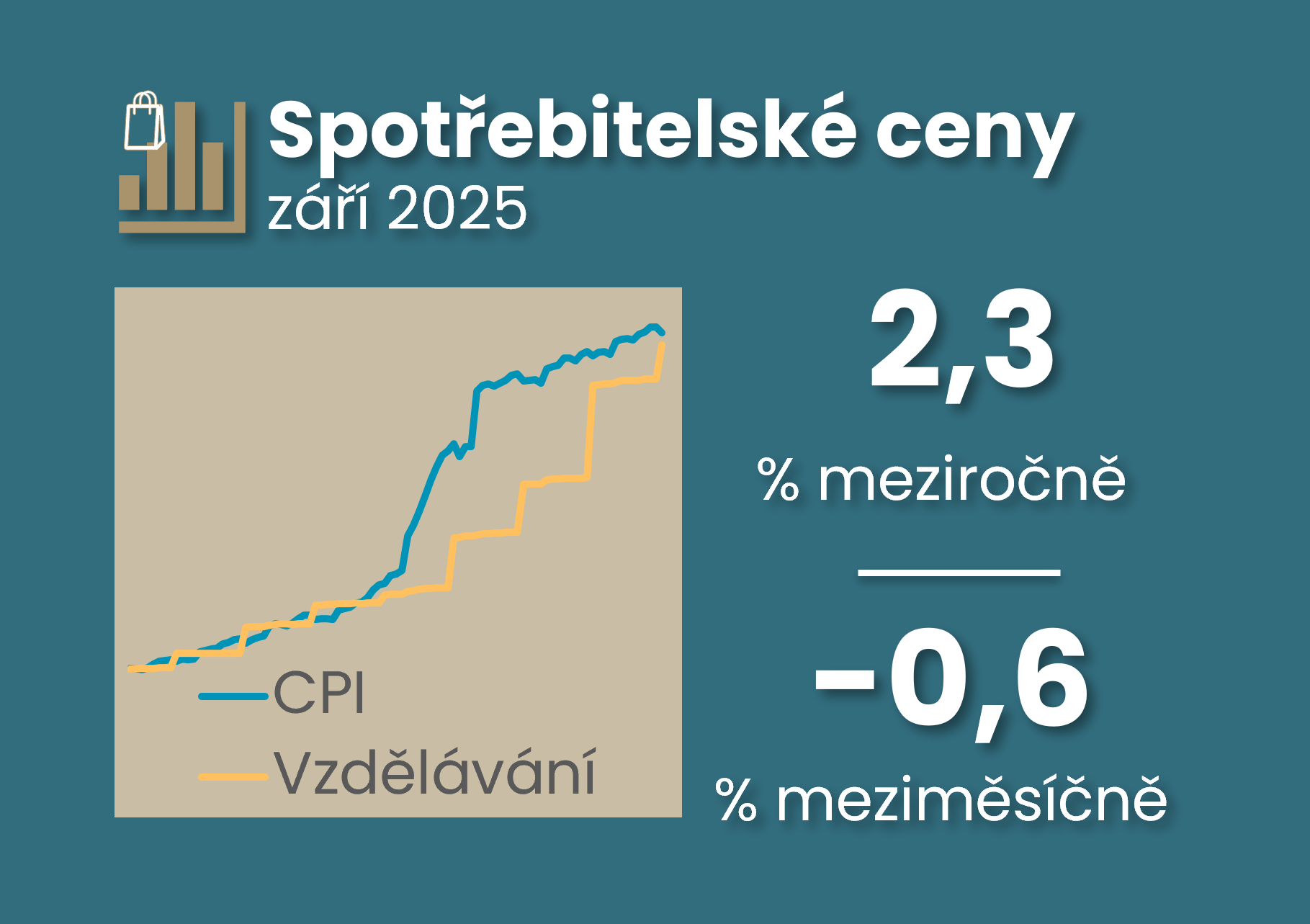

Comment by Jaromír Šindel, Chief Economist of the CBA: Lower food prices, a seasonal decline in holiday prices and a slight catch-up in education prices contributed to September's more moderate consumer price growth of 2.3%, which, however, reminds us of possible price catch-up in other segments next year as well (see Chart 4).

Comment by Jaromír Šindel, Chief Economist of the CBA: The continuation of the construction boom and the recovery in retail sales in August was dampened by the return of weaker industrial production, despite stronger exports. However, the positive sentiment in September suggests that the slowdown in GDP growth in Q3 may not be as pronounced as the July and August figures suggest.

Comment by Jaromír Šindel, Chief Economist of the CBA: The more pronounced slowdown in September consumer price growth to 2.3% year on year reflects a decline in most components of the consumer basket. There are three messages for the CNB that are likely to leave the CNB's communication unchanged, i.e. open to all interest rate possibilities.

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Comment by Jaromír Šindel, Chief Economist of the CBA: The recovery in disposable income in Q2 was still dampened by fiscal policy, so it remained weaker compared to the increase in wages and property prices. Nevertheless, households managed to increase both consumption and their savings.

Comment by Jaromír Šindel, Chief Economist at the CBA: While the CNB unsurprisingly left interest rates unchanged with the two-week repo rate at 3.5%, the Board's statement on the monetary policy settings, however, was more surprising in its less hawkish tone, leaving open all possibilities for future monetary policy settings.

Comment by Jaromír Šindel, Chief Economist at the CBA: September sentiment brings a boost after weaker monthly data in July and thus better prospects for GDP growth - mainly thanks to retail trade and construction.

Commentary by Jaromír Šindel, Chief Economist of the CBA: Higher-than-expected wage growth will be the main, but not the only, reason for keeping the interest rate at 3.5% at the CNB's September meeting and for the intensification of the hawkish tone in the communication. The latter may indeed indicate a further upward movement in the interest rate, but rather in an unspecified distant horizon. A stronger koruna or tighter monetary policy through the longer end of the yield curve is unlikely to lead the CNB to a dovish mindset.

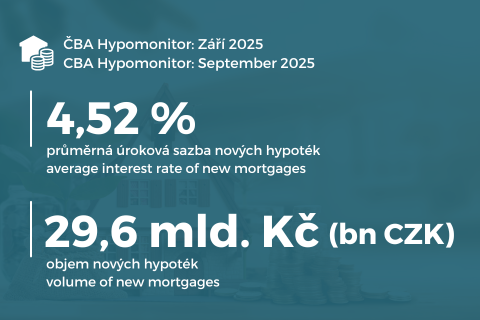

The rate fell slightly to 4.52%.

Economic commentary by Jaromír Šindel, Chief Economist of the CBA: I estimate overall growth in realised house prices of 4.2% quarter-on-quarter, which has outpaced wage growth for the sixth quarter in a row.

Economic commentary by Jaromír Šindel, Chief Economist of the CBA: CPI growth slowed to 2.5% yoy in August, but core inflation accelerated slightly to 2.8% in line with the CNB's forecast. The core services price segment, excluding imputed rent, accelerated month-on-month in August, but its three-month average remains well below the pace observed in H1-2025.

Economic commentary by Jaromír Šindel, Chief Economist of the CBA: Although the economy breathed a half-percent growth in the second quarter, the July figures were rather disappointing and suggest a cooling. However, the Czech economy is generating upside risks to inflation, which limits the room for manoeuvre of the CNB, which is likely to stick to the CNB's 3.5% terminal interest rate thesis. August's registered unemployment confirmed a worse trend, which, however, is not confirmed by other data.

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

The Czech Banking Association's forecast panel expects the domestic economy to grow by 2.1% this year. The estimate is more optimistic than the May forecast, which predicted only 1.7% for this year. The improvement comes despite the higher 15% US tariffs, which are expected to remain in place in 2026.

The Czech economy is expected to grow by 2.1% this year, while next year it should be a tenth less. The forecast is thus more optimistic than the May forecast, which only counted on 1.7% for this year. The improvement comes despite the higher 15% US tariffs, which are expected to remain in place in 2026.

August 2025: the CBA improved its outlook for the Czech economy. 2.1% growth confirms resilience and slightly higher inflation leads to a more cautious CNB

The rate fell slightly further to 4.53%.

Economic commentary by Jaromir Šindel, Chief Economist of the CBA (adjusted for published data on core inflation from the CNB and registered unemployment data, 18:00 8 August)

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

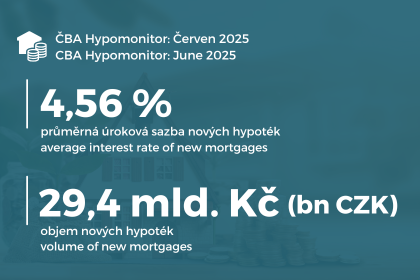

In June 2025, banks and building societies granted new mortgages worth CZK 29.4 billion.

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

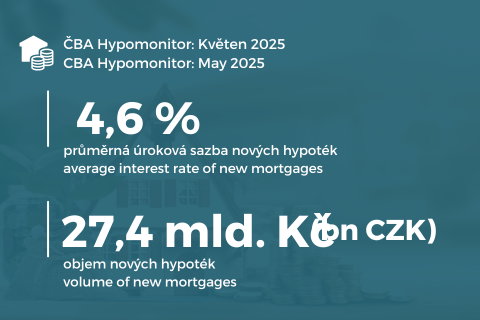

Average mortgage rate fell to 4.6%

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

The Czech Banking Association has downgraded its growth outlook for the domestic economy this year to 1.7%. The February macroeconomic forecast had expected growth of 2.1%. The negative impact of the trade wars and the uncertainty associated with them contributed significantly to the lower outlook. Next year, the growth rate should accelerate slightly to 2.0%.

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

The Czech economy will grow more slowly this year, by 1.7%. This is expected by the CBA macroeconomic forecast. The negative impact of trade wars and the uncertainty associated with them have significantly contributed to the worse outlook. Next year, the growth rate should accelerate slightly to 2.0%.

May 2025: the CBA has downgraded the outlook for the Czech economy. It will grow by 1.7% this year, 2% next year. Economists predict 12% US tariffs

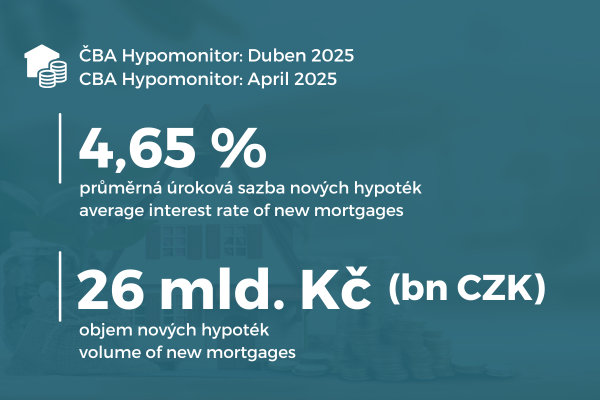

Despite the slight correction, April continued to see strong volumes of new mortgages supported by another slight decline in the average mortgage rate to 4.65%.

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Significant slowdown in April consumer inflation to 1.8% yoy, but still strong core inflation growth

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

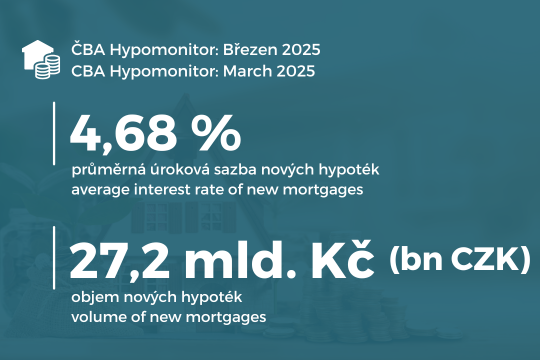

March continued to see strong new mortgage volumes supported by another slight fall in the average rate to 4.68%

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Trump's Reciprocal Tariffs, vol. II: Will Trump's reciprocal tariffs maths affect the EU's response?

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

The CNB Bank Board left interest rates unchanged in March.

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

February still suggests continued strong volumes of new mortgages, thanks to a further decline in the average rate to 4.72%.

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

House prices up 10.7%

The Czech economy will grow by 2.1% this year. According to the CBA's macroeconomic forecast. The outlook is significantly affected by the uncertainty of trade wars. In the baseline scenario, we expect consumer prices to grow by a similar annual rate of 2.4% this year as last year, with only a slight slowdown to 2.2% in 2026.

The domestic economy will grow by 2.1% this year, according to the CBA's macroeconomic forecast. The outlook is significantly affected by uncertainty about the onset of trade wars. In the baseline scenario, we expect consumer prices to grow by a similar annual rate of 2.4% this year as last year, with only a slight slowdown to 2.2% in 2026. The CNB's interest rates are likely to continue to fall gradually, with the two-week repo rate reaching 3.25% this year and 3% next year.

February 2025: the CBA worsened the economic outlook

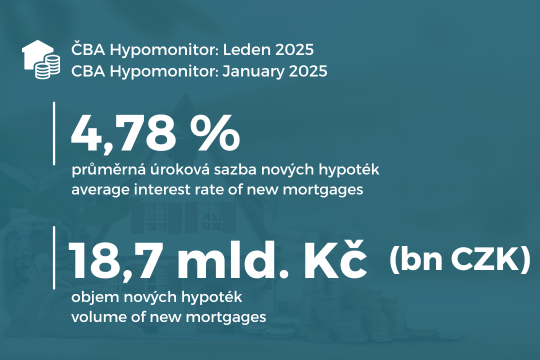

Average mortgage rate fell to 4.78 per cent

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

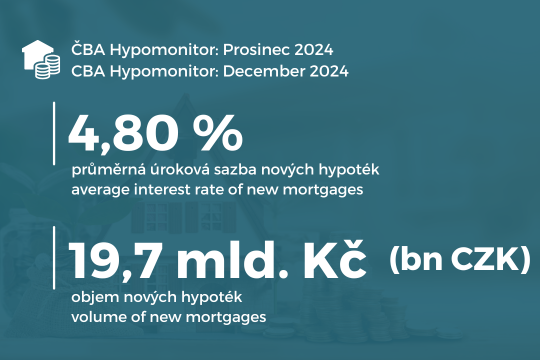

Average mortgage rate fell to 4.8 percent

Economic commentary by Jaromir Šindel, Chief Economist of the CBA

Economic commentary by Jaromír Šindel, Chief Economist of the CBA

Economic commentary by Jaromír Šindel, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

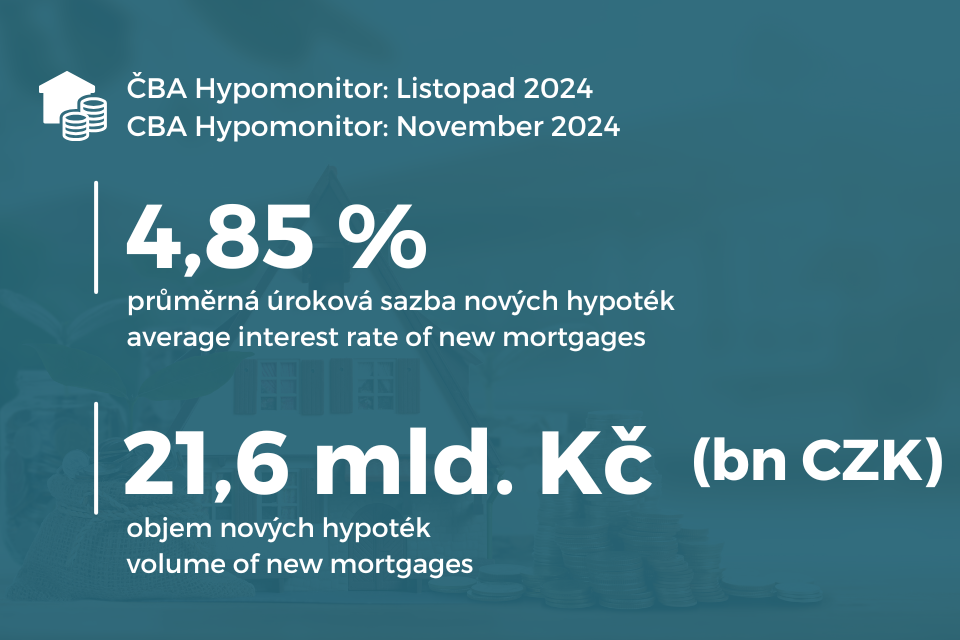

Average mortgage rate fell to 4.85 per cent

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

The domestic economy would grow by 1% year on year this year, similar to the value expected in the previous forecast. GDP is forecast to accelerate by 2.3% next year. Compared to the previous forecast, the estimate for 2025 has been revised downwards by almost half a percentage point, mainly due to weaker developments abroad.

Average mortgage rate fell to 4.9 per cent

The Czech economy will grow by 1% year-on-year this year, with GDP forecast to accelerate by 2.3% next year. Compared to the previous forecast, the estimate for 2025 has been revised downwards by almost half a percentage point, mainly due to weaker developments abroad.

November 2024: Domestic economic growth will be moderate this year, targets just above 2% next year, but slower than expected in the August forecast

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

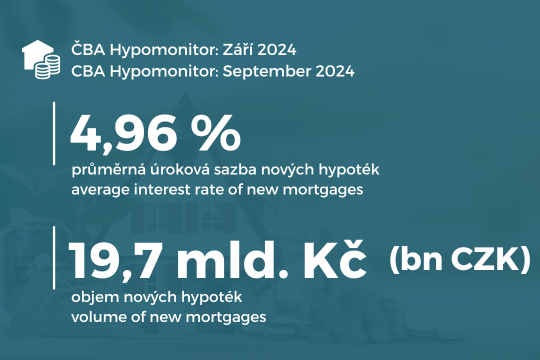

Average mortgage rate fell to 4.96 per cent

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Industry above expectations in August due to the impact of the holidays, stagnated during the summer

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

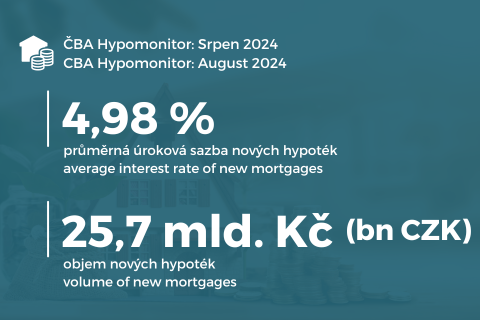

The average mortgage rate fell to 4.98 percent, the lowest in two years

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

The domestic economy will grow more slowly than expected this year. Annual growth will be 0.9%, down half a percentage point from the May forecast. The weaker development is linked to the unfavourable outlook for foreign demand.

Economic commentary by Jakub Seidler, Chief Economist of the CBA

The domestic economy will grow more slowly than expected this year. Annual growth will be 0.9%, down half a percentage point from the May forecast. The weaker development is linked to the unfavourable outlook for foreign demand. In the next episode, we will interview economist Jaromír Šindel.

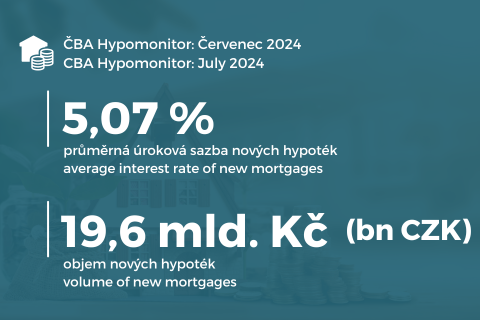

The average rate increased slightly to 5.07 percent

Economic commentary by Jakub Seidler, Chief Economist of the CBA

August 2024: Growth of the domestic economy will be weaker this year, the optimistic expectations from the previous forecast have not been met

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

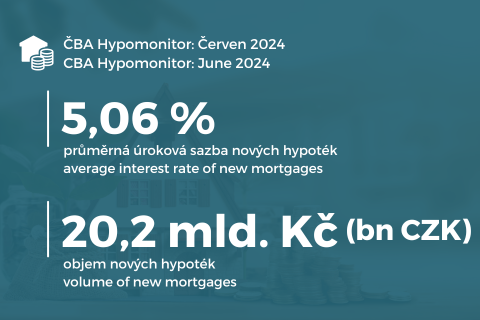

Average interest rate fell to 5.06%

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

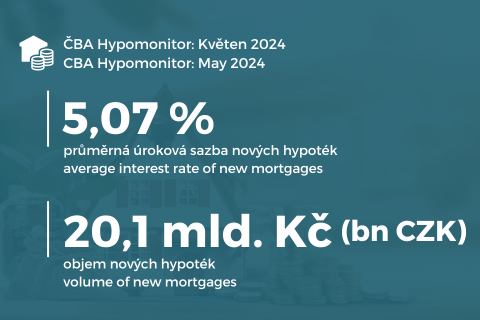

The average mortgage rate fell to 5.07% in May.

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

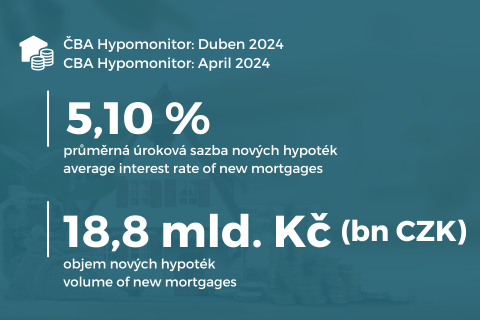

The average mortgage rate fell to 5.10%.

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

May 2024: This year's recovery will be gradual, growth should accelerate next year, inflation will remain at the central bank's 2% target this year and next

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

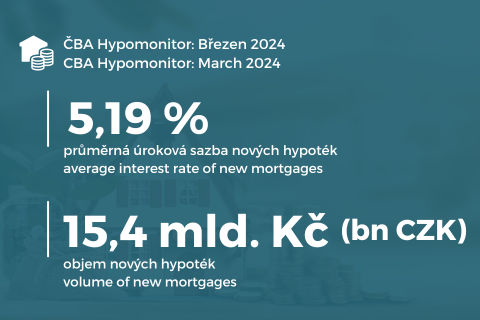

Average mortgage rate fell to 5.19%

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

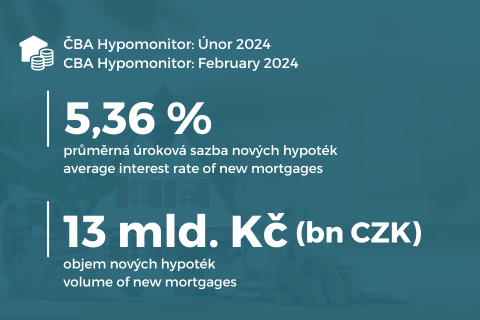

Average mortgage rate fell to 5.36% in February

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Sales of older and new homes increased by tens of percent during 2023

Economic commentary by Jakub Seidler, Chief Economist of the CBA

February 2024: The domestic economy will recover slowly this year. Growth expected to be only 1.2%, inflation close to central bank's target

Interview with Jakub Seidler, Chief Economist of the Czech Banking Association

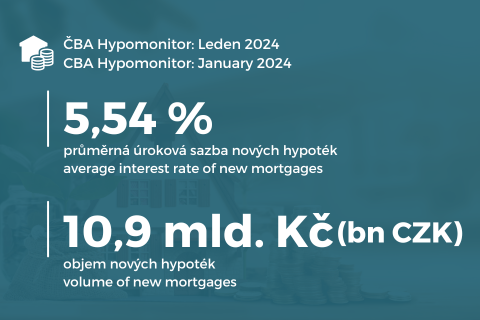

Interest in mortgages almost doubled year-on-year in January.

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Interview with Jakub Seidler, Chief Economist of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Interview with Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Interview with Jakub Seidler, Chief Economist of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

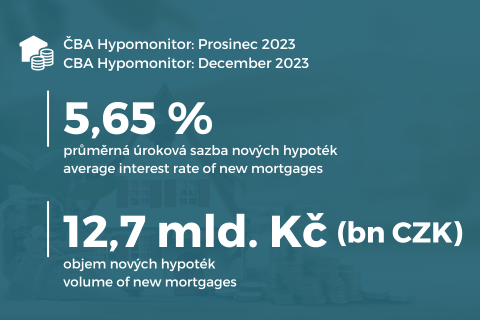

Mortgage market continues to revive, interest rate fell to 5.65% in December

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Commentary by Miroslav Zámečník, Chief Advisor of the Czech Banking Association

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

Economic commentary by Jakub Seidler, Chief Economist of the CBA

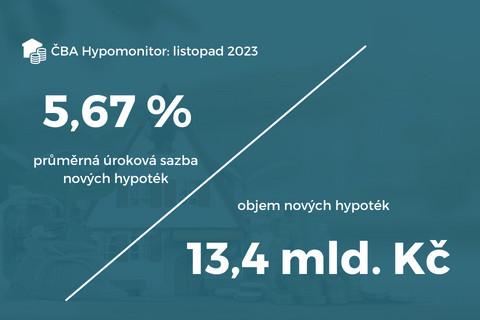

CBA Hypomonitor: Mortgage market held at October level in November, interest rate fell to 5.67 %